100% CFE Success

March 7, 2022

2022 Personal Tax Filing

February 21, 2023Maximizing the Tax Benefits of

Your Fertility Treatments

Starting in 2022, the definition of medical expenses has been broadened to include expenditures related to fertility-related procedures and In vitro fertility programs that were not previously allowed. Here’s how to take advantage of the benefits.

What can I claim?

- Payments made to your Canadian fertility clinic or donor bank

- Prescribed medications or drugs

- When travelling from at least 40km away:

- Mileage for travel to and from the fertility clinic, claimable at $0.51 per km

- When travelling from at least 80km away:

- Hotel expenses

- Claim meals at $23 per meal or keep the actual meal receipts if they’re a higher amount

- Parking fees

How much are the tax benefits?

- The above expenses plus any other non-fertility medical expenses are combined for the entire household

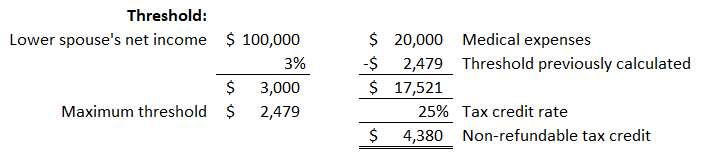

- 3% of the net income of the lower income spouse is subtracted (this subtraction is capped at $2,479 for 2022 and $2,635 for 2023)

- For Albertans, the non-refundable tax credit received is approximately 25% of the excess expenses above the threshold amount

Example

Fertility treatments are highly individualized and the process varies so much from family to family. The tax benefits therefore also vary significantly from family to family, but as a basic example, consider an Alberta family with a $20,000 treatment cost and no travel costs. The tax benefits for this family could put $4,380

back in their pockets.

What records do I give to my accountant?

- All receipts for payments to your fertility clinic and prescriptions

- Write down the dates of your trips to and from the clinic

- Keep all receipts for hotels and parking

If you want to learn more about maximizing your tax benefits, we would be happy to assist. You can reach a member of our professional team by calling our office. Our professional team helps clients all across Canada and can be reached at (403) 526-5011.